Waterfall Innovations Limited

Technology

Risk & Compliance

Orchestral Platform.

Imagine a world where risk and compliance processes are streamlined, efficient, and cost effective. The future of Waterfall promises exactly that.

Our Mission

Revolutionising

Risk Management

Our mission is to revolutionise and shape the way regulated firms manage their risk operations and regulated functions departments in their business.

From ATMs in the 1960s to mobile banking apps and blockchain today, fintech has constantly innovated the way we manage money. The internet revolutionised finance with online banking and payment processors, while smartphones ushered in mobile wallets and a wave of specialised fintech startups. Now, blockchain and AI are pushing the boundaries with DeFi and machine learning-powered finance, with open banking initiatives promising even more 4 competition and disruption in the years to come. Fintech isn't just a trend; it's reshaping how we interact with money.

Managing Risk and Compliance operations in a fast growing fintech landscape has become expensive, perplexed and labyrinthine. The everchanging regulatory landscape, providing only guidelines rather than instructions, have driven multiple interpretations, methods, policies and processes doing the same exact thing. They only differ in size and designed to overshoot the target generating frustration internally, bad customer journey externally and overwhelming costs in general.

Failing to comply or adequately manage the Risk & Compliance operations in a regulated fintech landscape can result in two main issues:

1. Action by the Regulator – These can be anything from license disqualification, financial fines to a warning. Being sanctioned by the regulator means effectively a red flag to the business and in worst-case scenarios it means the firm needs to close down.

2. Financial loss – fintech’s in general are high revenue low margins business models e.g. they make a small percentage from a much larger transaction. Fraud, cyberattacks and merchants insolvencies are the main cause of large losses in fintech firms. Being uninsured or not having the skill set to prevent and predict financial loss.

An additional factor, rarely spoken of, however, has the main impact on a fintech firm in terms of innovation, scale, growth and cost are the people hired, employed and retained by the firm. Although the technology driving the fintech industry growth from a product innovation perspective, grew 100x and scaled globally, the hiring process remains the same. Despite failing at this specific area time and time again, firms continue to hire, employ and retain people that are unproductive, have narrow view of their task or understanding of the landscape they operate in and as a result they are unproductive or inefficient

Gathering a pool of fintech professionals that are expert in their field, knowledgeable with wide view of the fintech landscape, commercial minded, adaptive and productive, is not impossible.

Furthermore, the majority risk operation resources are focused on preventing “Bad actors” and “Bad Transactions” from going through the various filters set but the tools, policies and processes created by each organisation. The subjective nature and success of the organisation in doing so, is highly conditional and definitely not “bullet proof”. Generating whitelisted traffic e.g. transactions in which both consumer, merchant and transactions are secured, insured and guaranteed to provide a successful outcome to both consumer and seller is the 4th item we want to solve.

Finally, we are completely aware that regulated firms and payment aggregators will not handover their regulatory oversight and obligations to a 3rd party without the 3rd party capacity to assume all relevant liability and take full financial responsibility for the services they provide. For that reason, Waterfall Technology Risk & Compliance Orchestration Platform will assume regulatory liability oversight and financial loss responsibility for services and decisions provided by the platform.

The Platform

Waterfall Innovations Limited aims to enable all relevant risk operation infrastructure and services in different scale to be able to cater to Large, Medium and Small regulated firms.

Core

Services

Backend Core Platform

(Optional for regulated firms) – PCI DSS Tier 1 secured technology and database platform to which the merchant can add their product developments and integrate to banking rails, merchant acquiring banks and Payment service providers for acquiring and issuing.

Core Products Environment

Umbrella of outsourced services required to enable the regulated firm risk operation activity. These variety of services are required for the orchestration of risk operation services. These can be provided by Waterfall Tech or contracted externally by the merchant and integrated to the core product environment via API integration.

3rd Party Service Providers

The different 3rd party service providers partner with Waterfall Tech are part of the API integration service offer operated through Waterfall Tech or the merchant can use any existing 3 rd party provider of service to manage the Risk & Compliance operations of the firm. i.e. Virtual Identity Verification (VID) providers, PEP & Sanctions verifications providers, Fraud prevention tools, Automated scorecard tools (scoring consumers, merchants and transactions).

Waterfall Tech CRM Systems

Operating Pipeline dashboards and review queues management systems – In this environment the day-to-day operating activity can be managed and viewed by the firm. The CRM system generates productivity reports, conversion reports, MI and BI databases and dashboards.

Business Model

Managing regulatory requirements in a landscape of inevitable change.

For regulated entities

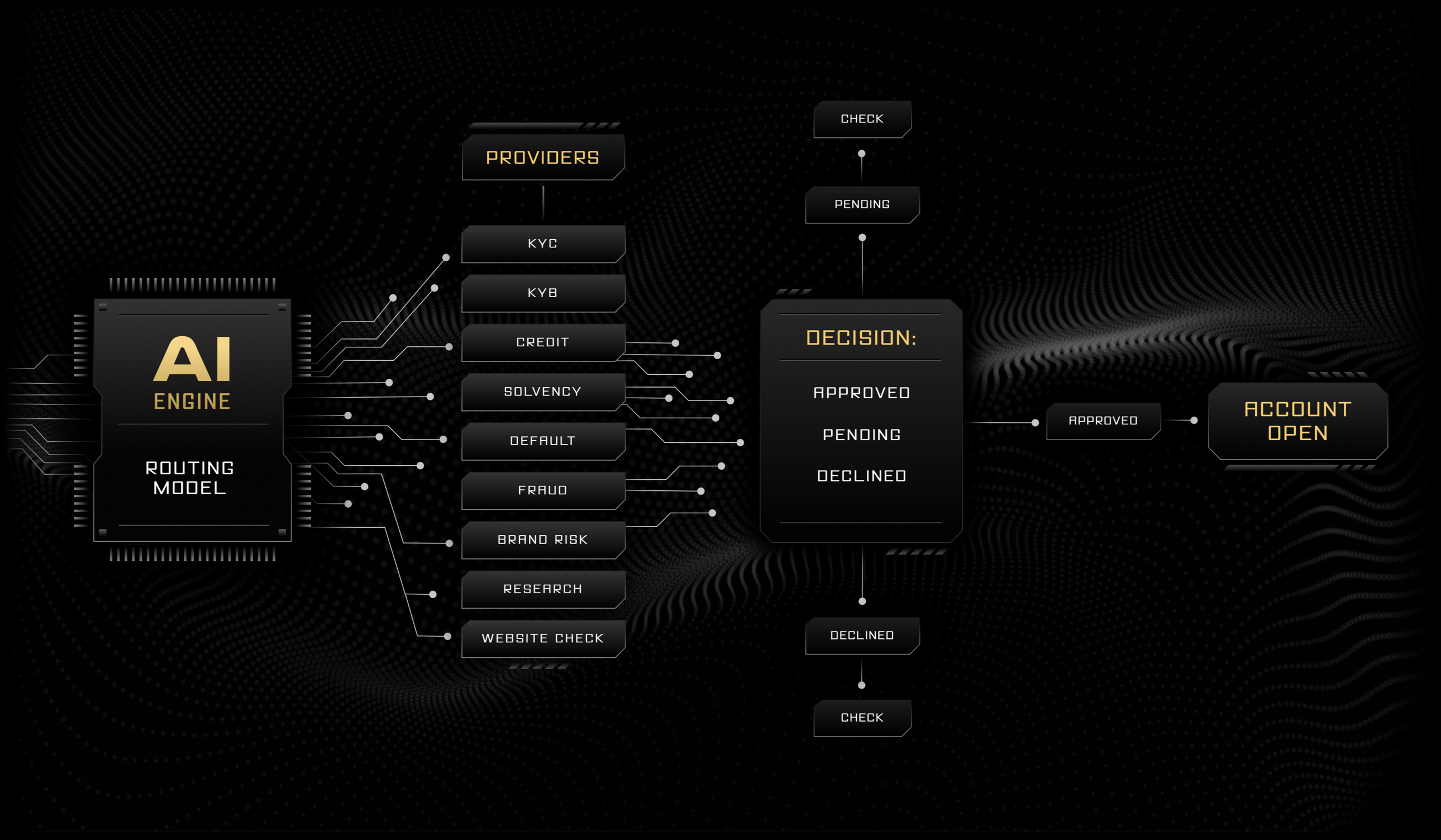

Waterfall Innovations platform automates first-line-of-defence (1LOD) risk operations in onboarding and monitoring customers and transactions, streamlines risk management and compliance processes using an AI-powered platform, leveraging machine learning algorithms, automated decision scorecards and digital agents. Human expertise remains integrated through manual reviews, ensuring a comprehensive holistic approach.

This powerful combination reduces costs, minimises risk exposure, and optimises efficiency across the entire risk and compliance lifecycle. Waterfall empowers organisations to manage both internal processes and customer interactions seamlessly, for a superior overall experience.

For unregulated entities

Waterfall Innovations provides whitelisted traffic e.g. verified and guaranteed customers and transactions (verified payments, verified customers, protects from fraud and abuse of scheme rules).

This allow merchants of all industries to accept payments through their chosen gateway knowing the payments and whoever made the payments, has been checked, verified and the transactions are 100% guaranteed from fraud and scams. Our customers get REAL TIME alerts of bad actors operating in their environment in events such as Mules and/or Account Takeovers. Services or any deliveries supply chain vendors are alerted to fraud so they can reverse delivery and/or block service.

How it works

Pre-seed Funding

Marketing

& Sales plan

Initial pre-seed funding round is based solely on R&D, Licensing applications, MVP buildup and product testing with selected merchants, for a period of no more than 18-24 months with 3 main paid employees Managing Director, Head of Risk Compliance and MLRO and Chief Technology Officer (CTO). This is the min. skeleton crew required for the buildup and testing of the MVP.

Pre-seed funding of £2mil is requested for that purpose only. (We hope to obtain an additional £2mil through innovation grants available in the UK via Innovation UK and other government grant programs).

Budget Allocation (Flexible)

- Digital Marketing (40%): £400,000

- Content Marketing (20%): £200,000

- Sales & Lead Generation (20%): £200,000

- Events & Public Relations (10%): £100,000

- Marketing Tech & Analytics (10%): £100,000

Digital Marketing (40%)

- Search Engine Optimization (SEO): (£150,000)

- Pay-per-Click Advertising (PPC): (£150,000)

- Social Media Marketing: (£100,000)

Content Marketing (20%)

- Blog & Website Content: (£100,000)

- Email Marketing: (£50,000)

- Customer Stories & Case Studies: (£50,000)

Sales & Lead Generation (20%)

- Sales Team Development: (£50,000)

- Sales Automation Tools: (£50,000)

- Lead Generation Activities: (£100,000)

Events & Public Relations (10%)

- Industry Events & Trade Shows: (£50,000)

- Public Relations & Media Outreach: (£50,000)

Marketing Tech & Analytics (10%)

- Marketing Automation Tools: (£50,000)

- Marketing Analytics & Reporting: (£50,000)

Market Analysis

Estimated value

of the opportunity

Our aim is to target and market to 5 niche industries where regulatory framework and oversights, in addition to whitelisted traffic is an invaluable asset.

Global:

The global fintech market is projected to reach a staggering $32.17 trillion by 2028, according to Grand View Research (2023).

UK:

The UK boasts a significant fintech presence, valued at around £240.6 billion ($290.7 billion) in 2023 (Statista).

Data Sources:

Grand View Research StatistaGlobal:

The online gambling market is estimated to reach $146.43 billion by 2028, according to Mordor Intelligence (2023).

UK:

The UK online gambling market is valued at around £14.5 billion ($17.5 billion) in 2023, as reported by the UK Gambling Commission (2023).

Data Sources:

Mordor Intelligence UK Gambling CommissionGlobal:

The global e-commerce marketplace size is expected to hit $8.1 trillion by 2026, according to Statista (2023).

UK:

The UK e-commerce marketplace is estimated to generate £262.1 billion ($315.3 billion) in revenue in 2023 (Statista)

Data Sources:

StatistaGlobal:

The global online travel agency market is projected to reach $923.2 billion by 2027, according to Grand View Research (2023).

UK:

The UK online travel agency market is estimated to be worth around £22.3 billion ($26.8 billion) in 2023 (Statista).

Data Sources:

Grand View Research StatistaGlobal:

The global video game industry is estimated to reach a value of $242.39 billion in 2023 and is expected to grow significantly, reaching $583.69 billion by 2030, according to Grand View Research (2023). This encompasses various segments like console, PC, and mobile gaming.

UK:

The UK video game industry is a major player, generating revenue of around £6.9 billion ($8.3 billion) in 2023, according to a report by Newzoo (2023).

Data Sources:

Grand View Research NewzooFinancial projections

Required funding and financial forecast

Funding required

Funding required

Stage 1

Stage 2

Development stage

12mnt to MVP

$0

Modules

Onboarding + EDD

$300,000

Product development

$500,000

$500,000

Technology partners (fees)

$250,000

$800,000

Partner integration

$150,000

$800,000

Licences

$150,000

$400,000

Wages

$100,000

$800,000

Total funding required

$1,300,000

$400,000

Financial forecast

Forecast

Year 1

Year 2

Year 3

Year 4

Year 5

Revenue

$1,000,000

$3,000,000

$9,000,000

$27,000,000

$81,000,000

COS (S&M + Sales Commission + Integration)

$200,000

$600,000

$1,800,000

$5,400,000

$16,200,000

GP

$800,000

$2,400,000

$7,200,000

$21,600,000

$64,800,000

OPR Cost

$340,000

$1,020,000

$3,060,000

$9,180,000

$37,260,000

OPR PR

$460,000

$1,380,000

$4,140,000

$12,420,000

$37,260,000

Forecast

Year 1

Year 2

Year 3

Year 4

Year 5

Customers

3

10

20

40

80

Consumer (CDD)

$100,000

$300,000

$900,000

$2.700,000

$8,100,000

Merchant

$24,000

$72,000

$216,000

$648,000

$1,944,000

Revenue CDD

$400,000

$1,200,000

$3,600,000

$10,800,000

$32,400,000

Revenue Enterprise

$600,000

$1,800,000

$5,400,000

$16,200,000

$48,600,000

Revenue MMR

$4,500

$15,000

$30,000

$60,000

$120,000

Total

$1,000,000

$3,000,000

$9,000,000

$27,000,000

$81,000,000

Price CDD

$4

Price Enterprise

$25

Annual service fee

$1,500

Closing statement

Why invest in our business?

My journey in fintech began in 2012 at PayPal's Merchant Risk Operations Underwriting Department, a time when "Risk & Compliance" was a single, unified work flow. I had a front seat firsthand view of Financial Services industry's pain points and growth pains of the global regulatory oversights for over a decade. It has been a privilege, but also a source of frustration. As top performer, I reviewed over 2,500 businesses annually for 9 years, gaining invaluable insights into diverse business models and their struggles. My problem-solving skills were recognized – I even received awards for rescuing "lost merchants" and generating revenue from seemingly unviable situations.

My career path included leading PayPal's High Risk Vertical (HRV) Global team, managing the COVID taskforce through the pandemic, followed by leadership roles at Paysuite Access Group and ZEN.COM. But this experience is more than just a resume.

Since 2012, I've anticipated the rise of RegTech. I saw how a fintech's success hinges on delivering exceptional product value and a smooth customer experience. However, risk and compliance departments, with their policies and processes, often work at odds with this vision. Instead of supporting growth through governance and resource protection, they become an industry-wide burden.

My mission is to revolutionize this landscape. I envision a state-of-the-art Risk & Compliance Orchestration Platform, powered by expert human oversight and AI/Machine Learning models. This platform will enhance both the firm's and its customer's experience, fostering trust and reliability while minimizing risk exposure.

The confluence of emerging technologies like Artificial Intelligence (AI), Machine Learning (ML) blockchain, core banking platforms, and transaction protection insurance, coupled with the lack of a comprehensive platform solution, creates the perfect storm for entry into the RegTech market. My goal is to build the world's first Risk & Compliance Orchestration Platform, forever changing how businesses manage Risk & Compliance.

I am not just passionate about this vision; I am uniquely qualified to lead its execution. My experience managing high-risk environments, coupled with a deep understanding of customer needs and frustrations, makes me the ideal partner.

I invite you to join me in building a future where innovation thrives alongside robust risk management.